Some Known Details About Personal Loans copyright

Wiki Article

Some Known Questions About Personal Loans copyright.

Table of ContentsThe Definitive Guide for Personal Loans copyright10 Simple Techniques For Personal Loans copyrightOur Personal Loans copyright IdeasFascination About Personal Loans copyrightThe Greatest Guide To Personal Loans copyright

Let's dive into what an individual loan actually is (and what it's not), the reasons people use them, and exactly how you can cover those crazy emergency costs without handling the concern of financial obligation. An individual finance is a swelling amount of cash you can obtain for. well, virtually anything., but that's practically not a personal lending (Personal Loans copyright). Individual finances are made through a real monetary institutionlike a bank, debt union or on the internet lender.

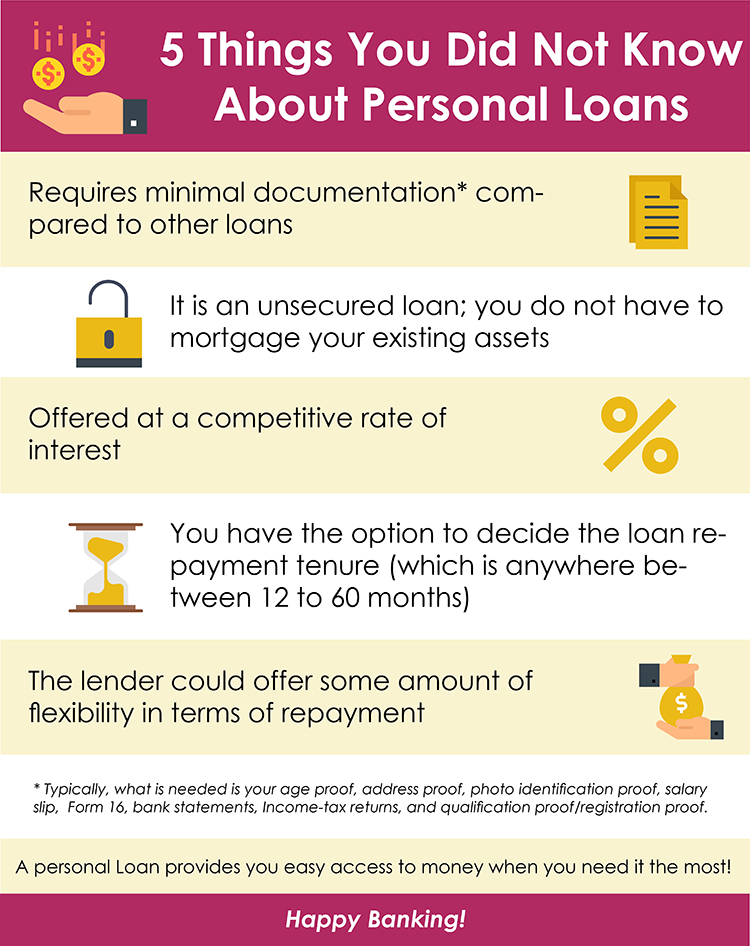

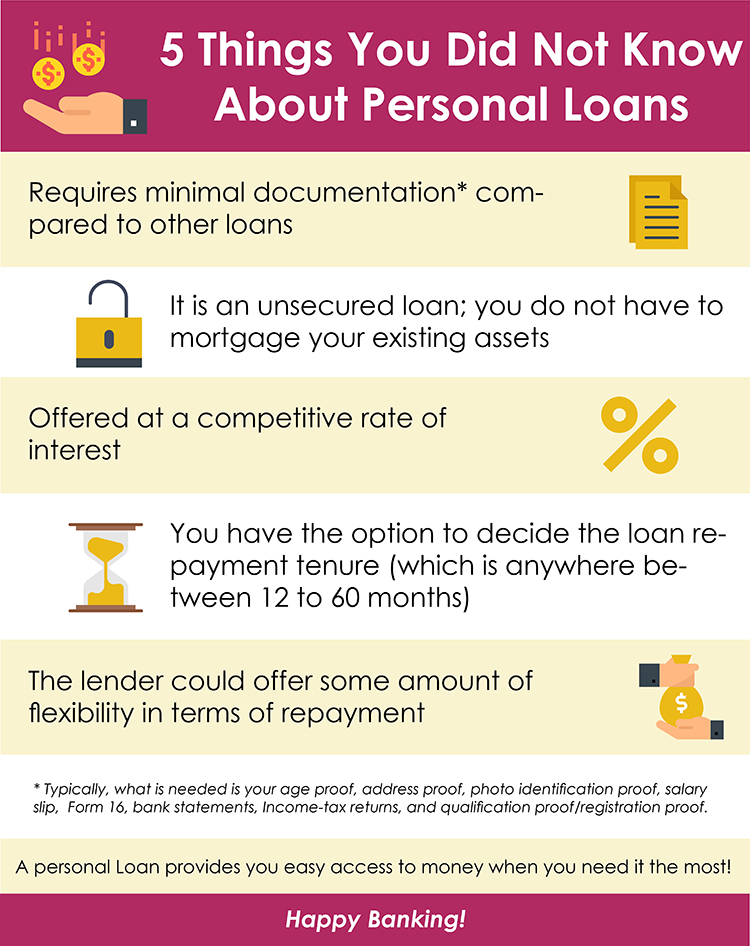

Allow's have a look at each so you can recognize exactly just how they workand why you don't require one. Ever. A lot of personal financings are unprotected, which means there's no collateral (something to back the loan, like a car or home). Unsafe fundings typically have greater rate of interest and call for a better debt score due to the fact that there's no physical item the lending institution can remove if you don't compensate.

7 Easy Facts About Personal Loans copyright Explained

Surprised? That's okay. No matter how good your debt is, you'll still need to pay interest on many personal car loans. There's always a cost to pay for borrowing money. Secured personal lendings, on the other hand, have some sort of security to "safeguard" the loan, like a watercraft, precious jewelry or RVjust to call a couple of.You might also take out a safeguarded personal loan utilizing your car as security. Trust fund us, there's nothing secure about guaranteed finances.

Just since the settlements are predictable, it does not mean this is a great bargain. Personal Loans copyright. Like we said previously, you're practically ensured to pay passion on a personal funding. Simply do the math: You'll wind up paying means more in the long run by securing a funding than if you 'd just paid with money

Everything about Personal Loans copyright

And you're the fish holding on a line. An installation lending is an individual financing you pay back in repaired installations with time (usually when a month) until it's paid in full - Personal Loans copyright. And don't miss this: You need to pay back the initial loan amount before you can borrow anything else

Do not be misinterpreted: This isn't the very same as a credit rating card. With personal lines of credit, you're paying interest on the loaneven if you pay on schedule. This kind of funding is incredibly difficult since it makes you believe you're managing your financial obligation, when truly, it's managing you. Payday car loans.

This one gets us irritated up. Since these businesses prey on individuals who can not pay their expenses. Technically, these are short-term financings that provide you your paycheck in breakthrough.

The Best Guide To Personal Loans copyright

Why? Because points you can look here obtain real untidy actual fast when you miss out on a settlement. Those creditors will certainly follow your sweet grandma that guaranteed the financing for you. Oh, and you must never guarantee a financing for any person else either! Not just might you get stuck to a lending that was never meant to be yours to begin with, yet it'll ruin the relationship before you can claim "pay up." Depend on us, you do not desire to get on either side of this sticky situation.Yet all you're truly doing is using brand-new financial debt to settle old debt (and expanding your loan term). That just indicates you'll be paying much more in time. Business understand that toowhich is specifically why numerous of them use you consolidation car loans. A reduced rate of interest does not get you out of debtyou do.

And it starts with not obtaining any kind of even more money. ever. This is an excellent general rule for any kind of monetary purchase. Whether you're thinking of getting an individual finance to cover that kitchen area remodel or your overwhelming bank card bills. do not. Obtaining financial obligation to pay look at these guys for points isn't the method to go.

Rumored Buzz on Personal Loans copyright

The best point you can do for your economic future is get out of that buy-now-pay-later way of thinking and state no to those investing impulses. And if you're taking into consideration a personal financing to cover an emergency, we get it. Yet borrowing money to pay for an emergency situation just escalates the anxiety and challenge of the situation.

Report this wiki page